MEDDIC vs SPICED vs BANT: Which Sales Methodology Fits Your SaaS?

MEDDIC vs SPICED vs BANT: Which Sales Methodology Fits Your SaaS?

Here's a prediction: you'll read this comparison, decide which framework sounds best for your team, implement it... and six months from now your reps still won't be using it consistently.

That's not a knock on the frameworks. MEDDIC, SPICED, and BANT all work when properly executed. The problem is that most comparison articles focus entirely on which framework to choose while ignoring the more important question: how will you make sure your team actually uses it?

This guide covers both—because picking the "right" methodology that nobody executes is worse than picking an "okay" methodology that everyone follows.

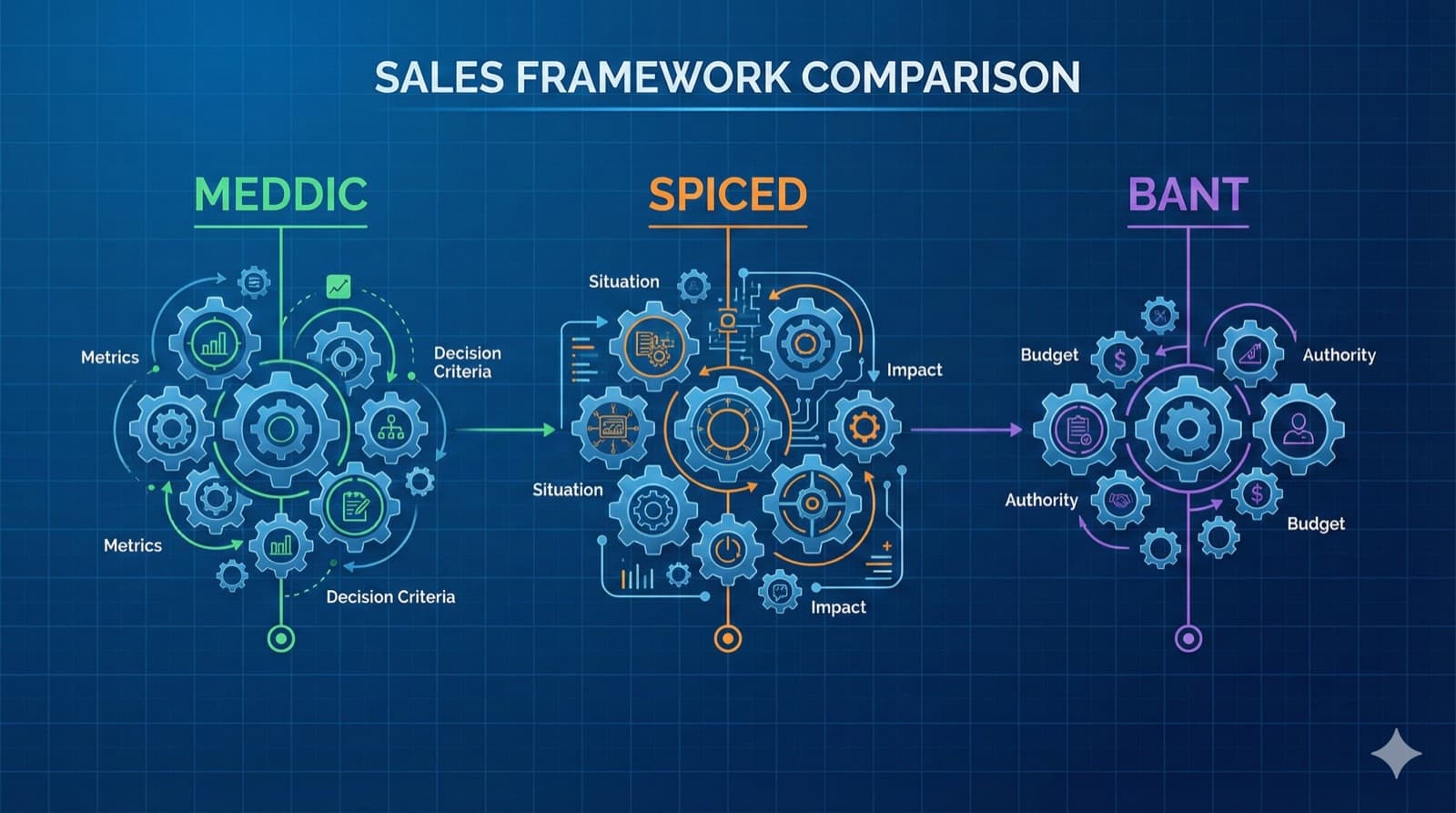

The Three Frameworks at a Glance

| Framework | Origin | Best For | Primary Focus |

|---|---|---|---|

| MEDDIC | PTC (1990s) | Enterprise, complex sales | Deal qualification & navigation |

| SPICED | Winning by Design | SaaS, recurring revenue | Customer outcomes & value |

| BANT | IBM (1960s) | Transactional, high-volume | Basic qualification |

MEDDIC: The Enterprise Workhorse

What MEDDIC Stands For

| Letter | Element | Definition |

|---|---|---|

| M | Metrics | Quantifiable results the customer wants to achieve |

| E | Economic Buyer | The person who can approve the purchase |

| D | Decision Criteria | What the customer will evaluate |

| D | Decision Process | How the purchase decision will be made |

| I | Identify Pain | The problems driving the purchase |

| C | Champion | Your internal advocate at the customer |

When MEDDIC Works Best

Ideal for:

- Enterprise sales with $100K+ deal sizes

- Complex buying committees (5+ stakeholders)

- Long sales cycles (3-12 months)

- Technical or transformational purchases

- Competitive displacement deals

Why it works: MEDDIC forces reps to understand the full buying landscape—not just the immediate contact. In enterprise deals, the rep who maps the decision process and identifies the real economic buyer wins.

MEDDIC Strengths

- Comprehensive qualification: Covers all critical deal elements

- Forecasting accuracy: Well-executed MEDDIC predicts outcomes

- Deal navigation: Guides reps through complex organizations

- Champion validation: Tests whether you have real internal support

MEDDIC Weaknesses

- Complexity: Six elements are hard to track consistently

- Execution gap: Reps learn it but don't apply it live

- CRM overhead: Requires detailed data entry that reps resist

- Early-stage friction: Asking about "economic buyer" in discovery can feel awkward

MEDDIC Execution Checklist

For each opportunity, can you answer:

- Metrics: What specific, quantifiable outcome does the customer want?

- Economic Buyer: Who can sign the contract? Have you engaged them?

- Decision Criteria: What are they evaluating? Technical? Business? Both?

- Decision Process: What steps happen between "yes" and signed contract?

- Identify Pain: What problem is urgent enough to drive action?

- Champion: Who will sell internally when you're not in the room?

SPICED: The SaaS-Native Approach

What SPICED Stands For

| Letter | Element | Definition |

|---|---|---|

| S | Situation | Current state and context |

| P | Pain | Problems and challenges |

| I | Impact | Business impact of the pain |

| C | Critical Event | Trigger or deadline driving urgency |

| E | Event/Decision | How and when they'll decide |

| D | Decision | Who decides and what criteria |

When SPICED Works Best

Ideal for:

- SaaS companies with recurring revenue models

- Mid-market sales ($25K-$100K ACV)

- Customer success-oriented organizations

- Land-and-expand motions

- Shorter sales cycles (1-3 months)

Why it works: SPICED emphasizes understanding the customer's situation and the impact of their pain—key for selling outcomes rather than features. The "Critical Event" element is particularly valuable for SaaS, where urgency often determines whether deals close.

SPICED Strengths

- Customer-centric: Focuses on outcomes, not just qualification

- Natural conversation flow: Elements map to discovery questions

- SaaS-aligned: Built for recurring revenue and customer success

- Urgency focus: Critical Event prevents pipeline bloat

SPICED Weaknesses

- Less comprehensive on buying process: Lighter on decision mapping

- Assumes single decision maker: Less robust for complex committees

- Newer framework: Less established best practices

- Critical Event dependency: Some deals don't have natural urgency

SPICED Execution Checklist

For each opportunity, can you answer:

- Situation: What's their current state? What tools do they use now?

- Pain: What specific problems are they trying to solve?

- Impact: What's the business cost of the pain? Revenue? Productivity?

- Critical Event: What's driving the timeline? Why act now?

- Event: What's their evaluation process?

- Decision: Who decides and based on what criteria?

BANT: The Classic Qualifier

What BANT Stands For

| Letter | Element | Definition |

|---|---|---|

| B | Budget | Do they have money allocated? |

| A | Authority | Are you talking to a decision maker? |

| N | Need | Do they have a problem you solve? |

| T | Timeline | When do they want to buy? |

When BANT Works Best

Ideal for:

- High-volume, transactional sales

- SMB and small mid-market

- Short sales cycles (days to weeks)

- Clear, well-defined product categories

- Inbound lead qualification

Why it works: BANT is simple. For high-velocity sales where you need to quickly qualify or disqualify, the four elements cover the basics. SDRs can apply it immediately.

BANT Strengths

- Simplicity: Easy to learn and apply

- Speed: Quick qualification decisions

- Universal: Works across industries

- SDR-friendly: Good for initial qualification

BANT Weaknesses

- Shallow qualification: Misses deal complexity

- Budget first trap: Leading with budget kills conversations

- Modern buying mismatch: Doesn't account for consensus buying

- No champion concept: Ignores internal advocacy

BANT Execution Checklist

For each opportunity, can you answer:

- Budget: Is there budget allocated or can they create it?

- Authority: Does your contact have decision-making power?

- Need: Do they have a problem your product solves?

- Timeline: When do they need a solution?

Head-to-Head Comparison

Complexity vs. Simplicity

| Framework | Elements | Learning Curve | Execution Difficulty |

|---|---|---|---|

| MEDDIC | 6 | High | High |

| SPICED | 6 | Medium | Medium |

| BANT | 4 | Low | Low |

Deal Size Fit

| Framework | SMB (<$25K) | Mid-Market ($25-100K) | Enterprise ($100K+) |

|---|---|---|---|

| MEDDIC | Overkill | Good | Excellent |

| SPICED | Good | Excellent | Good |

| BANT | Excellent | Limited | Poor |

Sales Motion Fit

| Framework | Transactional | Consultative | Strategic |

|---|---|---|---|

| MEDDIC | Poor | Good | Excellent |

| SPICED | Good | Excellent | Good |

| BANT | Excellent | Limited | Poor |

What Each Framework Emphasizes

| Emphasis | MEDDIC | SPICED | BANT |

|---|---|---|---|

| Customer outcomes | Medium | High | Low |

| Buying process | High | Medium | Low |

| Internal champion | High | Low | None |

| Urgency/timeline | Medium | High | Medium |

| Budget | Medium | Low | High |

| Decision criteria | High | Medium | Low |

Choosing the Right Framework

Choose MEDDIC If:

- Your average deal size is $100K+

- You sell to enterprises with complex buying committees

- Your sales cycle is 3+ months

- Competitive displacement is common

- Forecast accuracy is critical

Choose SPICED If:

- You're a SaaS company focused on recurring revenue

- Your average deal is $25K-$100K

- Customer success and expansion are priorities

- Your sales cycle is 1-3 months

- You want a customer-centric approach

Choose BANT If:

- You have high-volume, transactional sales

- Your average deal is under $25K

- Sales cycles are days to weeks

- You need quick qualification for SDRs

- You're selling a well-understood product category

The Hybrid Approach

Many organizations use a hybrid:

- SDRs use BANT for initial qualification

- AEs use MEDDIC or SPICED for deal progression

This balances simplicity for early qualification with rigor for closing.

The Part Most Comparisons Skip

Most teams that "use" a methodology don't actually use it. They've trained on it. They have the CRM fields. They talk about it in reviews. But in live deals? Reps wing it and fill in the fields afterwards from memory.

This isn't a training failure—it's a systems failure. Live sales conversations don't pause for methodology checklists. Reps are listening, thinking, responding, and managing the relationship simultaneously. Asking them to also remember to ask about Decision Process is asking for a lot.

The Pattern We See

Training happens. Everyone's excited. Reps pass the quiz.

Then the first real calls happen. Customers don't follow the nice linear flow from the role plays. Reps focus on the conversation in front of them. CRM fields stay empty or get back-filled from imperfect memory. Managers notice the gaps in pipeline reviews—days or weeks after the moment where the information should have been captured.

By then, it's too late. You can't go back to a discovery call and ask about the Economic Buyer.

Making Methodology Execution Work

The framework you choose matters less than how well you execute it. Here's how to close the gap:

1. Embed, Don't Document

Instead of: Methodology in a playbook Try: Methodology embedded in daily workflow

The methodology should surface when reps need it:

- Before calls (what to ask)

- During calls (real-time prompts)

- After calls (what was missed)

2. Make It Easy to Capture

Instead of: 10 CRM fields to fill manually Try: Auto-capture from conversations

If reps discuss the economic buyer on a call, it should be captured automatically—not require them to remember and log it later.

3. Score, Don't Just Track

Instead of: Boolean "was MEDDIC discussed?" Try: Objective deal scores based on methodology execution

A deal with strong Champion and clear Decision Process should score higher than one missing both. Let the score inform forecasting.

4. Coach in Real-Time

Instead of: Methodology review in weekly pipeline meeting Try: Prompts and suggestions during live calls

When a rep finishes discovery without asking about Decision Process, they should know immediately—not in a review days later.

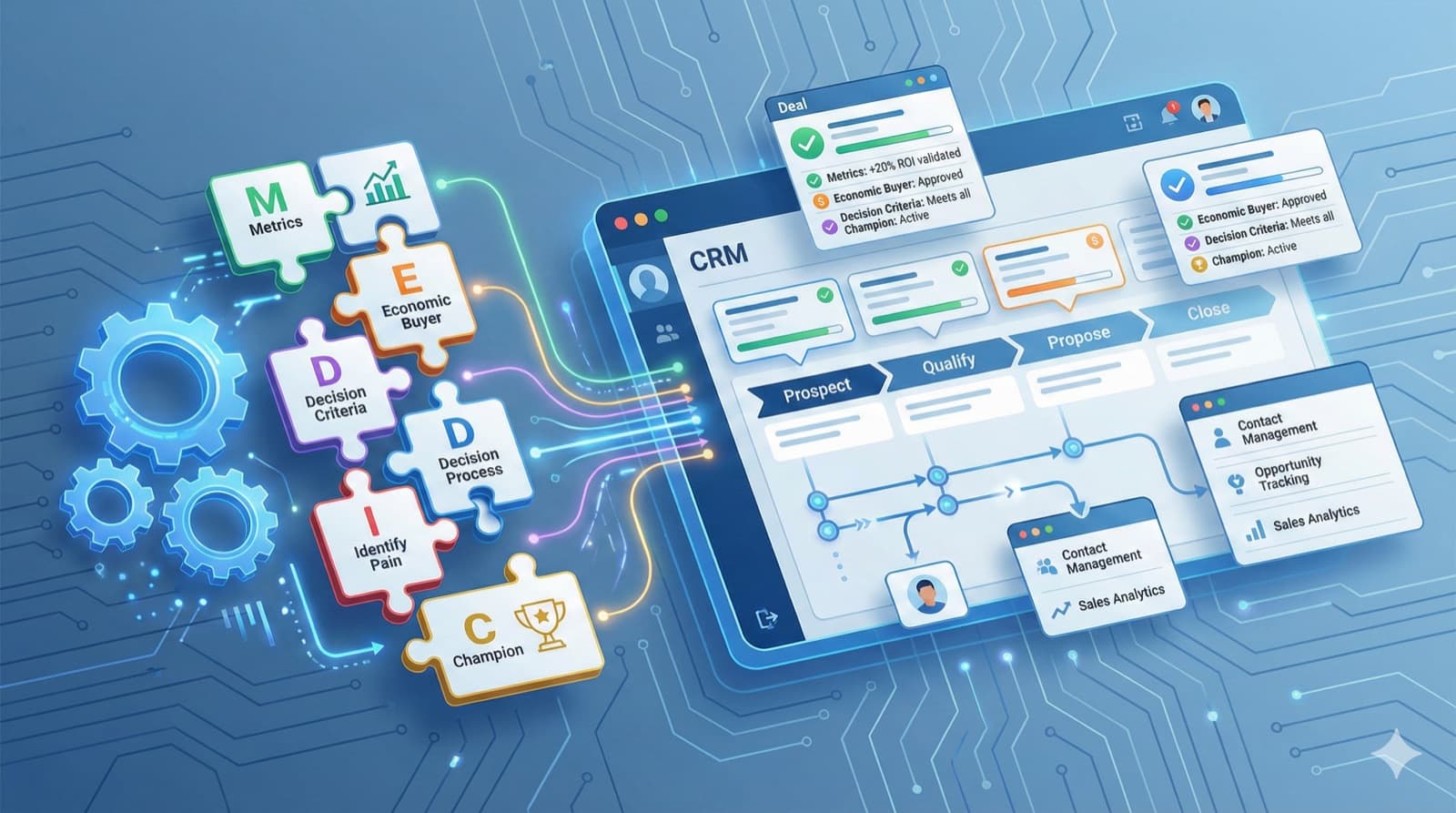

Action-Connected Intelligence

The shift from "passive methodology documentation" to "active methodology execution" is what we call action-connected intelligence.

Modern platforms like RevWiser can:

- Prompt methodology questions during calls

- Auto-capture responses and populate CRM

- Score deals against methodology criteria

- Flag gaps before they become problems

Implementation Guide

Week 1: Choose and Customize

- Select the framework that fits your sales motion

- Customize the elements for your product/market

- Define what "good" looks like for each element

- Create your scoring criteria

Week 2: Train the Team

- Workshop on the framework (2-4 hours)

- Role-plays covering each element

- Real opportunity reviews using the framework

- Assign homework: apply to current pipeline

Week 3-4: Embed in Process

- Update CRM with methodology fields

- Integrate methodology into meeting prep

- Add methodology review to deal stages

- Start tracking completion and quality

Ongoing: Measure and Iterate

- Track methodology completion rates

- Correlate methodology scores with win rates

- Identify which elements predict success

- Coach on weakest areas

Our Take

We've worked with teams using all three frameworks. Our honest assessment:

MEDDIC is the most comprehensive but also the most likely to become compliance theater—fields that get filled without actually reflecting reality. If you choose MEDDIC, budget significant effort for making it operational, not just training it.

SPICED is newer and feels more natural for SaaS, but it has less established playbook for implementation. You may need to build more of the supporting materials yourself.

BANT is genuinely useful for high-velocity sales but dangerous if applied to complex deals. We've seen teams use BANT to qualify in and then get surprised by complex buying processes they never mapped.

The honest truth: the framework matters less than whether you can make it stick. Pick one that fits your motion, customize it for your reality, and then spend most of your energy on execution infrastructure—not on debating which framework is theoretically superior.

RevWiser embeds MEDDIC, SPICED, and other methodologies into live deals with real-time prompts and automatic scoring. If methodology execution is your bottleneck, let's talk.

RevWiser Team

Content writer at RevWiser, focusing on go-to-market strategies and sales enablement.