The True Cost of Sales Ramp Time: A Data-Driven Guide for Revenue Leaders

When we ask sales leaders about their biggest scaling challenge, the answer is almost always hiring. But when we dig deeper, the real problem isn't finding people—it's making them productive.

The first 90 days of a new sales hire costs real money: salary, benefits, manager time, opportunity cost of deals they could be closing but aren't. A rough calculation puts this at $30,000+ per rep, and that's before you factor in the additional months to full productivity.

For companies hiring aggressively, this compounds fast. Ten new hires per year with 9-month ramp times represents a staggering amount of unrealized revenue.

What "Ramp Time" Actually Means

First, a definition problem: "ramp time" means different things to different organizations. Some measure time to first deal. Others measure time to quota. Others use "time to fully ramped" which is often loosely defined as "performing like experienced reps."

For this guide, we're using "time to consistent productivity"—roughly, when a rep can handle a full book of business without significantly more support than experienced reps need.

By this definition, industry benchmarks suggest:

- B2B SaaS: 6-9 months is common

- Enterprise sales: 9-12 months for complex products

- SMB/velocity: 3-6 months for simpler motions

Your mileage will vary based on product complexity, sales cycle length, and how much institutional knowledge is required.

The Real Costs (A Framework, Not a Calculator)

Ramp time costs fall into a few buckets. The exact numbers depend on your compensation structure and market, but here's how to think about it:

Direct Costs (First 90 Days)

| Cost Category | Calculation | Typical Amount |

|---|---|---|

| Base salary | 3 months × $8K/month | $24,000 |

| Benefits & overhead | 25% of salary | $6,000 |

| Training resources | Materials, tools, time | $2,000 |

| Manager coaching time | 40 hours × $75/hour | $3,000 |

| Total Direct Cost | $35,000 |

Opportunity Costs (Months 1-9)

| Cost Category | Calculation | Typical Amount |

|---|---|---|

| Ramping quota (Month 1-3) | 25% of full quota | -$37,500 in potential revenue |

| Ramping quota (Month 4-6) | 50% of full quota | -$75,000 in potential revenue |

| Ramping quota (Month 7-9) | 75% of full quota | -$37,500 in potential revenue |

| Total Opportunity Cost | $150,000 |

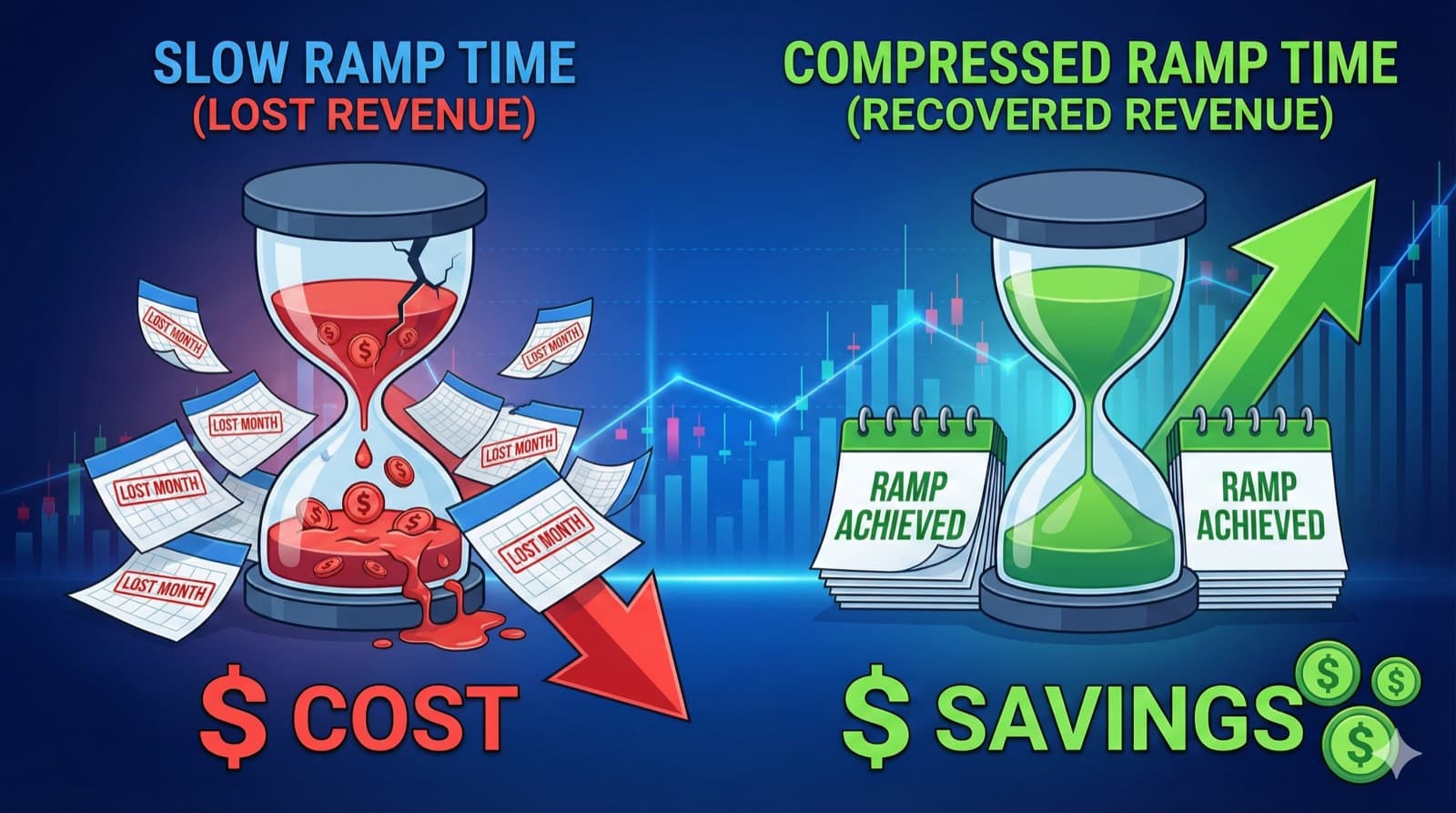

The Compounding Effect

For a company hiring 10 new reps per year with 9-month ramp times:

- Direct costs: $350,000

- Opportunity costs: $1,500,000

- Total annual impact: $1,850,000

That's nearly $2 million in lost productivity and revenue—just from slow onboarding.

Why Does Ramp Take So Long?

Understanding the root causes helps us solve the problem:

1. Tribal Knowledge Isn't Documented

Your top performers know things that aren't written down anywhere:

- Which objections actually close deals

- What questions to ask each persona

- Which case studies resonate with which industries

- How to navigate complex procurement processes

New reps don't have access to this institutional knowledge. They have to build it from scratch through trial and error.

2. Training Is Front-Loaded, Not Continuous

Traditional onboarding dumps information on new hires in the first 2-4 weeks:

- Week 1: Product training

- Week 2: Sales methodology

- Week 3: Tool training

- Week 4: Shadowing calls

The problem? 90% of training is forgotten within a week (Go1 Research). By the time reps are in live deals, they've forgotten most of what they learned.

3. Content Is Scattered

New reps don't know where to find information:

- Product specs are in Confluence

- Case studies are in Google Drive

- Pricing is in a spreadsheet

- Competitive intel is in someone's head

They spend hours searching instead of selling. Aberdeen Group found that reps waste 440 hours per year just looking for content.

4. Methodology Isn't Applied

You invested in MEDDIC or SPICED training, but:

- Reps forget the questions in live calls

- They back-fill CRM data from memory

- Managers only catch issues in forecast reviews—too late to fix deals

The methodology exists in a training deck, not in the workflow.

5. Context Is Missing

Generic training doesn't prepare reps for specific situations:

- What do you say when a CFO asks about ROI?

- How do you handle the "we're evaluating Competitor X" objection?

- What's the right case study for a fintech compliance use case?

Reps have to figure this out on their own, deal by deal.

The 5 Levers to Reduce Ramp Time

Based on research and real-world results, here are the highest-impact ways to cut ramp time:

Lever 1: Curate Knowledge (Impact: 20-30% reduction)

Instead of giving new reps access to thousands of documents:

Do this:

- Identify the ~100 most critical GTM assets

- Organize by use case, not by department

- Assign owners to keep content current

- Make it instantly searchable

Example transformation:

- Before: "Search Confluence for case studies" → 47 results, 12 outdated

- After: "Fintech compliance case study" → THE one current, verified story

Lever 2: Continuous Reinforcement (Impact: 30-40% reduction)

Replace front-loaded training with on-the-job learning:

Do this:

- Deliver micro-learning in the flow of work

- Reinforce concepts when they're relevant to current deals

- Use AI to surface knowledge at the moment of need

- Track what reps actually use, not just what they "completed"

The data: Arist research shows microlearning can reduce ramp time by 40% compared to traditional training.

Lever 3: Systematize Tribal Knowledge (Impact: 25-35% reduction)

Capture what top performers know and make it accessible:

Do this:

- Interview top performers about their winning patterns

- Document the "unwritten rules" of your sales process

- Create talk tracks for common objections

- Build a living playbook that evolves with feedback

Example: When a veteran knows that "compliance buyers always ask about audit trails," make sure every rep knows to address that proactively.

Lever 4: Embed Methodology (Impact: 20-30% reduction)

Make your sales process part of the workflow, not separate from it:

Do this:

- Integrate MEDDIC/SPICED questions into deal stages

- Auto-prompt reps for missing information

- Score deals against methodology criteria

- Provide next-step recommendations based on gaps

The shift: From "remember to ask about the decision process" to "you haven't identified the decision criteria—here's how to uncover it."

Lever 5: Provide Real-Time Guidance (Impact: 25-35% reduction)

Help reps perform better in the moment:

Do this:

- Auto-generate meeting prep briefs

- Surface relevant content during calls

- Offer live Q&A for product questions

- Provide suggested talk tracks for objections

The result: New reps have "veteran-level" context in every conversation.

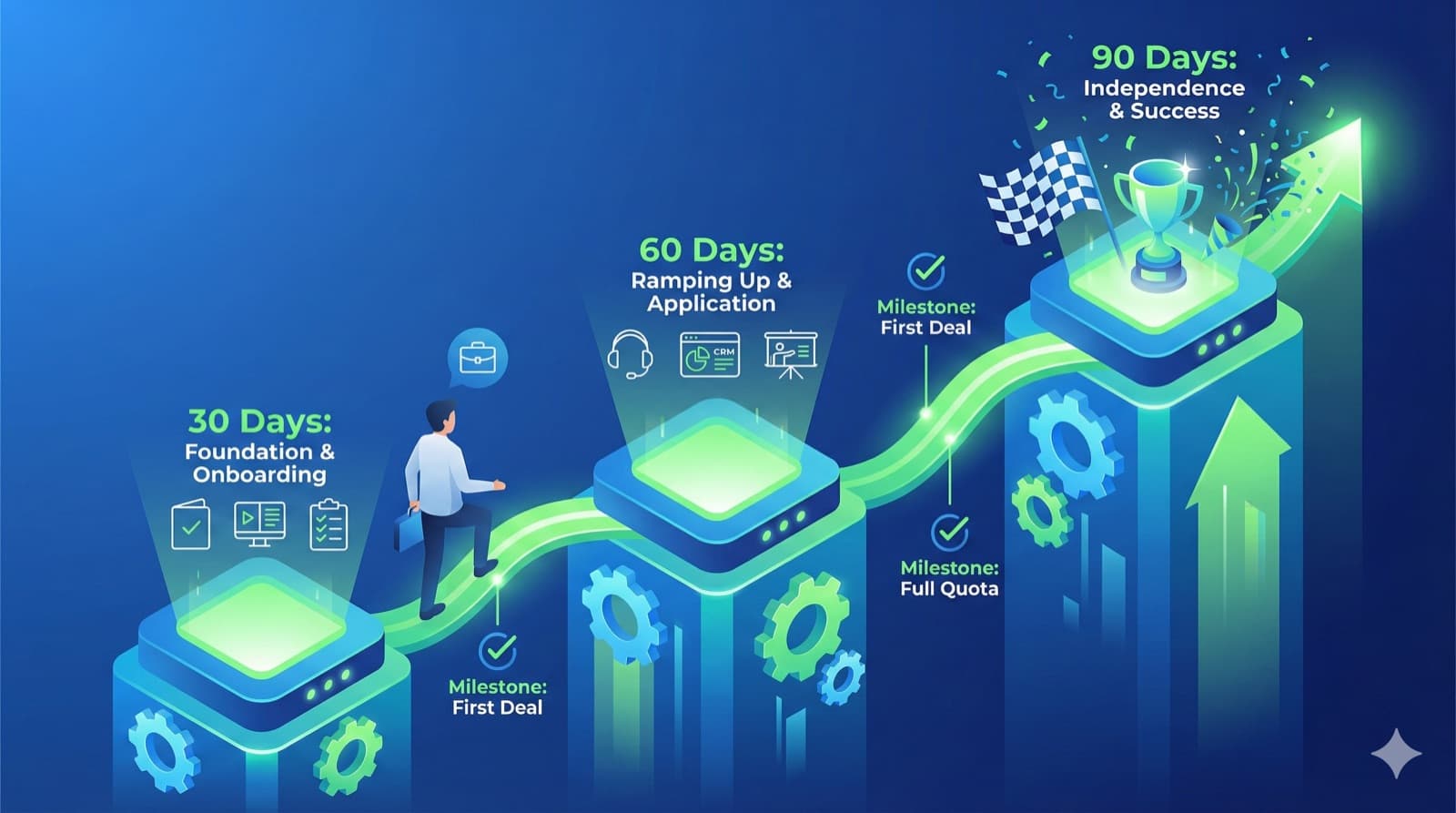

The 30-60-90 Day Ramp Framework

Here's a modern onboarding structure designed for faster ramp:

Days 1-30: Foundation + First Wins

Week 1: Core Knowledge

- Product fundamentals (not exhaustive features)

- ICP and buyer personas

- Key use cases and positioning

Week 2: Process Integration

- CRM and tools setup

- Sales methodology basics

- Meeting prep workflow

Week 3-4: Guided Practice

- Shadow calls with live guidance

- First discovery calls with backup support

- Real-time coaching and feedback

Target milestone: First qualified opportunity generated

Days 31-60: Expanding Capability

Focus areas:

- Handle common objections independently

- Run demos with minimal support

- Navigate multi-threaded deals

- Use competitive positioning

Support model:

- AI-assisted meeting prep for all calls

- On-demand Q&A for product questions

- Weekly 1:1 coaching sessions

- Deal reviews for complex opportunities

Target milestone: First deal advanced to proposal stage

Days 61-90: Building Momentum

Focus areas:

- Full sales cycle ownership

- Complex deal navigation

- Consistent methodology execution

- Proactive pipeline building

Support model:

- Reduced coaching frequency

- Self-service knowledge access

- Peer collaboration and learning

- Performance tracking against benchmarks

Target milestone: First closed deal or clear path to close

Measuring Ramp Success

Track these metrics to know if your ramp program is working:

Leading Indicators (Early)

- Time to first meeting: Days until first customer meeting

- Discovery call quality: Methodology adherence score

- Content usage: Are they using the knowledge base?

- Coaching engagement: Frequency and quality of manager feedback

Lagging Indicators (Later)

- Time to first qualified opportunity: Days until first real pipeline

- Time to first closed deal: Days until first revenue

- Quota attainment at Month 3/6/9: Progress toward full productivity

- 90-day retention: Are they staying and succeeding?

Benchmarks to Target

| Metric | Industry Average | Top Performers | Your Target |

|---|---|---|---|

| Time to first meeting | 14 days | 5 days | 7 days |

| Time to first qualified opp | 45 days | 21 days | 30 days |

| Time to first closed deal | 120 days | 60 days | 75 days |

| Full productivity | 9 months | 4 months | 6 months |

The ROI of Faster Ramp

Let's calculate what a 50% reduction in ramp time is worth:

For a Single Rep

- Current ramp: 9 months

- Improved ramp: 4.5 months

- Months of full productivity gained: 4.5

- Monthly quota: $50,000

- Additional revenue potential: $225,000

For a Team of 10 New Hires

- Additional revenue potential: $2,250,000

- Plus reduced training costs: $50,000

- Plus reduced churn risk: $150,000 (avoided replacement)

- Total first-year impact: ~$2,450,000

The Investment Math

If a GTM Intelligence platform costs $500/rep/month ($6,000/year), and you have 10 new reps:

- Annual cost: $60,000

- Annual benefit: $2,450,000

- ROI: 40x

Action Steps for Revenue Leaders

Ready to reduce ramp time? Start here:

This Week

- Calculate your current ramp time (time to full productivity, not "end of training")

- Survey recent hires: What slowed them down? What helped?

- Identify your top 3 tribal knowledge gaps

This Month

- Curate your core 100 GTM assets

- Implement continuous learning touchpoints

- Add methodology prompts to your deal stages

This Quarter

- Launch AI-assisted meeting prep

- Build objection handling talk tracks

- Create a 30-60-90 day structured program

A Caveat on ROI Claims

You'll notice we haven't said "RevWiser reduces ramp time by X%." That's intentional.

Ramp time reduction depends on too many factors—starting point, sales complexity, management attention, existing enablement—for us to claim a specific number that applies universally. What we can say is that the principles in this guide (continuous reinforcement, accessible knowledge, embedded methodology) consistently outperform front-loaded training approaches.

Whether you implement these principles with RevWiser, with other tools, or with manual processes, the direction is the same: make institutional knowledge accessible when reps need it, not just during onboarding.

The Bottom Line

Ramp time is a revenue problem, not an HR problem. Every month you shave off represents earlier quota contribution, better win rates from more experienced reps, and reduced churn risk from frustrated new hires who feel set up to fail.

The companies we see doing this well share a common trait: they've stopped treating onboarding as a training event and started treating it as an ongoing system. The specific tools matter less than the approach.

RevWiser connects product knowledge, sales methodology, and deal context into guidance that helps new reps perform faster. If ramp time is costing you revenue, see how we think about it.

RevWiser Team

Content writer at RevWiser, focusing on go-to-market strategies and sales enablement.